forbinfi®

Updated 10:51 AM CDT, Tue July 22, 2025

Published Under: Case StudiesSearch Engine Marketing

When it comes to paid search, it’s easy to feel like the biggest spender wins. But what if your credit union or community bank could outrank bigger players and spend less doing it?

This real case study shows exactly how one credit union used forbinfi's strategic Search Engine Marketing (SEM) program to scale from just 40–50 phone call conversions per month to over 1,200 — all while keeping their cost per conversion at only $0.68.

The Client:

CSE Federal Credit Union is a trusted financial partner serving Ohio since 1938. From affordable checking accounts to competitive auto and home loans, CSE FCU’s mission is simple: help local families and businesses thrive with reliable, community-focused banking.

The Challenge:

Despite steady loyalty from its member base, CSE FCU knew they were missing out on a new generation of local members searching for loans and accounts online.

They faced the same hurdles many community banks and credit unions do:

- Low Local Visibility: Big banks and aggressive fintechs dominated paid search ads for local banking keywords.

- Limited Conversions: Their old ads generated just 40–50 phone call conversions per month — not enough to move the needle for loans or new accounts.

- Rising Costs: Competing on generic search terms was driving up costs with little ROI.

- No Clear Tracking: Their campaigns weren’t set up to track which clicks turned into real actions like phone calls or applications, making it impossible to know what was working.

They needed a smarter strategy to win new members without blowing up their marketing budget.

The Solution:

That’s when CSE FCU partnered with forbinfi's SEM team to turn guesswork into growth.

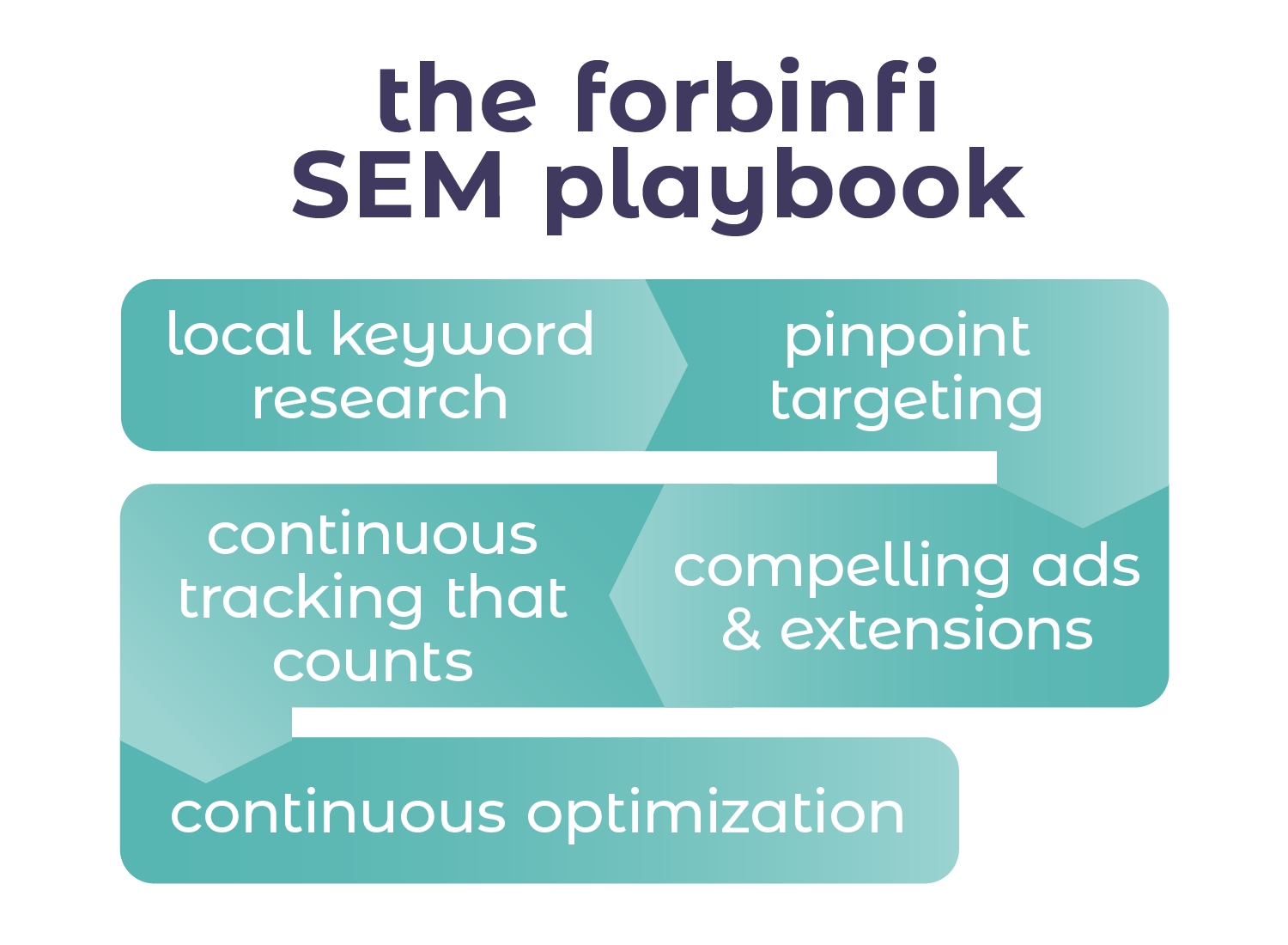

Here’s what made the difference:

1.️ Deep Local Keyword Research

Our team analyzed exactly how local families were searching for auto loans, checking accounts, and refinancing options — and what big banks were missing.

2. Pinpoint Local Targeting

We structured campaigns to capture only the traffic that mattered, cutting waste on irrelevant clicks and zero-intent search terms.

3. Better Ad Copy & Extensions

Instead of generic banking ads, new messaging spoke directly to Ohio members, emphasizing local roots and real community benefits.

4. Full-Funnel Conversion Tracking

forbinfi rebuilt campaign tracking so every phone call to loan officers and every new account form submission could be traced back to specific ads and keywords. No more guesswork, just clear, actionable data.

5. Ongoing Optimization — Not “Set It & Forget It”

Our team tested, adjusted, and refined ads every month to lower costs, scale budget to high-performing keywords, and adapt to seasonal promos.

Want a Free SEM recommendation?

Want to see what your spend should be for ads? forbinfi offers a no-strings SEM check to spot your best targeting parameters which can help build a plan for real results.

Request Your Free SEM Recommendation

The Results:

The numbers speak for themselves:

- Starting conversions: ~40–50 phone calls per month

- Current conversions: 1,200+ phone calls per month

- Cost per conversion: Only $0.68 — well below typical financial industry averages

More importantly? These aren’t just clicks — they’re real conversations that lead to new accounts, loan applications, and long-term growth.

“CSE has been working with forbinfi for our website and SEO/SEM work since 2019. We couldn’t be happier with the results. Our website stays relevant and robust while our digital advertising consistently outperforms expectations. The team is quick to respond and has delivered exactly what we want and then some. 10 out of 10 would recommend forbinfi.”

— Tim P., CSE FCU

Why forbinfi’s SEM Program Works

Most financial institutions overspend when they:

- Bid on broad keywords that don’t convert

- Target regions they don’t serve

- Run generic ads that don’t connect

- Forget to test and refine

- Can’t tie clicks to real conversions

forbinfi's difference?

- Financial industry focus

- Dedicated account managers

- Real conversion tracking

- Integrated strategy that works alongside your SEO, website, and content

What This Means for Your FI

You don’t have to outspend the big players — you just have to outsmart them. With a smarter SEM partner:

- Stretch your budget further

- Attract local prospects who actually convert

- Prove clear ROI to your board and stakeholders

- Grow memberships, loan applications, and revenue

Next Step: Let’s Talk SEM That Actually Works

Stop paying for clicks that go nowhere. See how forbinfi’s SEM program can help your credit union or community bank do what CSE FCU did — and more.

Book a Free SEM Recommendation

See How forbinfi Helps Banks & Credit Unions GroW With Other Marketing

Comments