forbinfi®

Updated Fri May 2, 2025

Published Under: Email Marketing

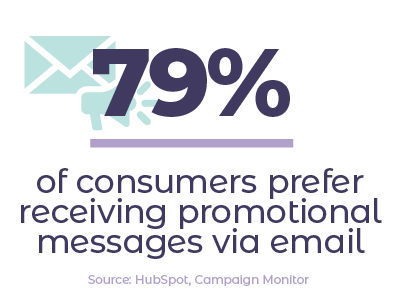

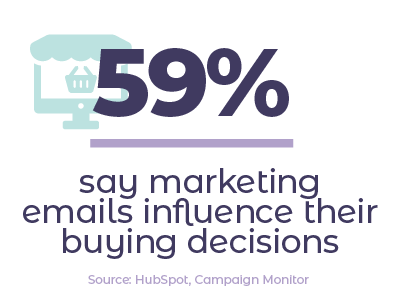

Email marketing is still one of the best tools banks and credit unions have to connect with customers, nurture relationships, and drive real results.

But with great power comes great responsibility—especially when it comes to compliance.

Between GDPR, CAN-SPAM, CCPA, and evolving privacy laws, financial institutions can’t afford to “wing it” anymore. Protecting your brand (and avoiding costly fines) means understanding the rules—and building smart strategies around them.

Let’s dive into everything you need to know to keep your bank’s email marketing compliant and effective in 2025.

What Is GDPR and Why Does It Matter for Bank Marketing?

The General Data Protection Regulation (GDPR) governs how organizations collect, store, and use personal data for individuals in the European Union (EU) and European Economic Area (EEA).

Even if your bank or credit union operates in the U.S., GDPR may apply if you serve EU citizens—making compliance a must.

Key GDPR principles for banks and credit unions:

- Lawfulness, fairness, and transparency: Get clear, informed consent before sending marketing emails.

- Data minimization: Only collect what you truly need.

- Accuracy: Keep customer information up-to-date.

- Storage limitation: Don’t hold onto data longer than necessary.

- Integrity and confidentiality: Protect personal data with strong cybersecurity practices.

Quick Tip: Make it easy for customers to update, correct, or delete their data. It builds trust—and keeps you compliant.

Understanding CAN-SPAM Rules for Financial Institutions

The CAN-SPAM Act sets the standard for commercial email marketing in the United States. Non-compliance can lead to fines, lost trust, and reputational damage.

Here’s what your bank’s emails must have:

- Accurate header information: Your “From,” “To,” and “Reply-To” fields must clearly identify your bank.

- Honest subject lines: Your subject must match the content of your email.

- Identify the message as an ad: Make it clear if the email is promotional.

- A physical postal address: This builds trust and is required by law.

- A simple opt-out option: Every marketing email must allow recipients to unsubscribe easily—and you must act on it quickly.

Even one mistake—like a misleading subject line or missing opt-out link—can lead to fines or damage your institution’s credibility.

Quick Tip: Keep internal records of consent and unsubscribe requests. Having a clear audit trail could protect your institution in a compliance review.

What is DMARC and Email Authentication?

Starting in February 2024, email providers like Yahoo and Gmail introduced stricter rules for bulk email senders to improve email security and deliverability. These rules require senders to implement email authentication protocols such as SPF, DKIM, and DMARC.

DMARC (Domain-based Message Authentication, Reporting & Conformance) is an email authentication protocol designed to protect your domain from unauthorized use, such as phishing and spoofing attacks. By implementing DMARC, you ensure that only legitimate emails from your domain reach your recipients' inboxes, improving your email deliverability and maintaining your brand's reputation.

How Can Banks Stay Ahead of Email Marketing Regulations?

The world of privacy laws doesn’t stand still. Regulations like California’s CCPA and Canada’s CASL have raised the bar for email compliance—and more updates are on the horizon.

Here’s how banks and credit unions can stay ahead:

- Review consent practices: Ensure every email contact gave explicit permission.

- Audit your templates: Check that unsubscribe links are clear and privacy policies are linked.

- Segment your audiences: Communicate differently with new leads, existing customers, and past clients.

- Avoid purchased email lists: Always build your own permission-based lists through honest signups.

- Track and maintain consent records: Keep detailed logs of when, how, and where customers opted in.

- Stay informed: Partner with marketing providers who actively monitor regulatory changes (like forbinfi!).

Need Help Staying Compliant and Competitive?

At forbinfi, we make it simple for financial institutions to create engaging, regulation-ready email campaigns—without the headache.

Explore Our Email Marketing Services

Why Banks Trust forbinfi for Email Marketing Compliance

We know financial marketing—and we know the rules. When you work with us, you get:

- Expert guidance on GDPR, CAN-SPAM, CCPA, and more

- Custom content that’s clear, compliant, and customer-focused

- Mobile-optimized, branded email templates

- Campaign execution with analytics and list management

- Ongoing support so you’re always ready for what’s next

Whether you need a monthly newsletter, onboarding series, or a one-time campaign, forbinfi delivers solutions designed specifically for banks and credit unions.

Learn More About Our Email Marketing Services

Key Takeaways: How to Keep Your Bank’s Email Marketing Compliant

- Follow GDPR principles: Focus on transparency, consent, and data protection.

- Meet CAN-SPAM requirements: Be honest, clear, and offer easy opt-outs.

- Stay ahead of evolving regulations: Regularly update your practices to stay compliant.

- Keep records: Track consent and unsubscribes for added protection.

- Work with trusted experts: forbinfi helps banks market smarter—and safer.

Comments